And so I introduced the students to Zerohedge as part of the curriculum. At the beginning of the course I reached out to Zerohedge with an idea. I had planned that the final exam would take the form of a take home project whereby each student would be tasked with some analytical problem. My proposal to Zerohedge was to publish the best final report. Zerohedge responded with an immediate “Absolutely”.

|

| Leo Martinic presenting in AIM Room |

The second half of the course was spent applying the concepts of analysis to real world data. In effect, the concept of applied financial modeling is not DCF or any other specific formulaic model but the application of data in a useful and meaningful way toward some objective. This requires a deep understanding of the inter-relatedness of all stimuli within the context of risk, growth and cash flow.

|

| Leo Martinic, AIM student |

The winning final

report was done by Leo Martinic, a junior and not surprisingly Leo is a member

of the AIM program, a student run investment group led by Business Faculty,

David Krause. This group manages about

$2M of the school’s endowment fund.

The assignment was

one question: Which is the better buy –

Amazon or Walmart?

Below is the

analysis presented by Leo Martinic.

FINA 4360 Leo Martinic Final Paper

Overview

A Look into Amazon

Amazon’s revenues have

soared since its inception, generating YoY growth of 20.2%, 19.5%, and 21.9%

for 2015, 2014, and 2013. Estimates for 2016 are even better, sitting at 24.7%.

This staggering revenue growth is due to CEO Jeff Bezo’s dedication to massive

capital expenditures and a current no dividend policy, averaging about $4.7

billion spent on capital expenditures per year over the past three fiscal

years. The capital expenditures have increased operating margins 943% in 2015

and 761% over the LTM. Although the huge plowback of cash into the business has

generated corresponding growth, it does not come without potential risk. It is

no guarantee that the large capital expenditures heading into the future will

yield Amazon’s historical growth rate. The ever-present risk with such large

capital expenditures is the fact that if it does not pay off by generating top

line results or cost efficiencies, then it is effectively flushing money down

the drain that could have otherwise been paid back to investors. This is

something Amazon and investors need to consider.

The organic growth is great, but operating expenses have grown 27.1%, 33.5%, and 35.8% for 2015, 2014, and 2013 along with similar, but not as severe, increases in COGS. The brunt of these hikes in cost are due to the increasing cost of shipping. In fact, the firm has been losing money on the shipping aspect of “Amazon Prime”. In 2015, Amazon charged $6.5 billion for shipping and ended up spending $11.5 billion, resulting in a shortfall of $5 billion. The shipping cost issue needs addressing if margins are going to improve. An issue with Amazon’s huge growth is that it has only yielded break-even bottom line results. It seems as if investors are infatuated with the staggering growth, but are not worried about current profit generation given Amazon is trading at a current P/E of 295.93 and the firm’s P/E has reached as high as 537 over the past year.

Management has continually

stated their current focus is on free cash flow, which they expect to generate

a significant bottom line result when the growth phase scales back. The belief

is that the massive capital expenditures will have set a foundation for

revenues to continue their climb while the focus shifts toward cost efficiency.

The promise of cash flow finally came to fruition in 2015, as Amazon generated

$7.33 billion in free cash flow yielding a 276% increase over the prior year.

Analysts believe this is the turning point for Amazon and expect these

staggering numbers to continue, starting with the top line and filtering to the

bottom line.

One worrisome fact with

Amazon is that total debt has also increased at a similar rate as just about

every one of the firm’s glowing statistics, increasing at a 58.6% CAGR over the

past five years. With Amazon we have massive revenue growth, high debt and

expenses, slim to no margins (other than gross margin!), and no true profit (as

of yet). As I was sifting through Amazon’s SEC filings, I found an 8-K worth

noting from February.

Amazon’s board of directors authorized a $5 billion share buyback plan, which I believe indicates that management is weary about earnings growth and will resort to considerable buybacks to inflate the stock price heading into the future. The buyback could be a signal that the growth story is nearing its end and this authorization could be a back-pocket option to hold up the stock price along with distributing cash with which the firm cannot find another productive use. The counter argument is that if substantial negative interest rates permeate over to the U.S., then Amazon would rather hold their own stock than lose money by sitting on idle cash.

Amazon’s board of directors authorized a $5 billion share buyback plan, which I believe indicates that management is weary about earnings growth and will resort to considerable buybacks to inflate the stock price heading into the future. The buyback could be a signal that the growth story is nearing its end and this authorization could be a back-pocket option to hold up the stock price along with distributing cash with which the firm cannot find another productive use. The counter argument is that if substantial negative interest rates permeate over to the U.S., then Amazon would rather hold their own stock than lose money by sitting on idle cash.

A Look into Walmart

Walmart is a completely

different story. Walmart’s revenue growth has slowly deteriorated from 11.8% in

2007 to -0.7% in 2016. This deterioration is signalling the world is moving

away from the “brick-and-mortar” provided by Walmart and more towards the

currently preferable online shopping. And perhaps more alarming the growth

deterioration may be signalling that consumption could actually be in decline..

With the decrease in revenue growth, Walmart has seen its operating income,

pretax income, and net income decrease 12.6%, 14.2%, and 10.2% respectively

from 2015 to 2016. This is the first time Walmart has seen such a pullback in

their historically superb results. Walmart’s workforce also received a

substantial wage hike of around $1.5 billion, which is bound to increase

notably in the future.

Walmart’s P/E sits at

14.71, not far off from its five-year average of 14.83. It is obvious that

Amazon and its online-only platform has eaten into Walmart’s grip on the retail

sector. With the fall in performance, Walmart continues to pay a 2.95% dividend

yield amounting to a $6.3 billion payout for 2016. The firm only carries $8.7

billion in cash on its balance sheet, so as cash flows begin to descend

Walmart’s ability to fund a high dividend payout will be questionable at best.

Cash dividend coverage has decreased from 6.39 in 1999 to 2.33 today, including

an alarming 10.3% drop from 2015 to 2016 alone. Walmart will continue to run

into trouble generating the cash necessary to pay their high dividend and soon

enough the firm will have to borrow in order to continue to satisfy shareholders.

With no growth, Walmart

will have to adjust in order to combat Amazon for the crown of the retail

sector. Walmart is the perfect case of how investors are looking for immediate

gratification, whether through stock price appreciation or through dividends.

Such a strategy ignores the fact that Walmart is being forced to cannibalize

itself from the inside out by trading future growth to satisfy investor hunger

today. In addition, Walmart has slowly bought back shares since the turn of the

century. In 2000, Walmart had 4.4 billion shares outstanding in contrast to the

3.1 billion outstanding today. The firm has decreased its outstanding shares

about 1-4% every year, while repurchasing 7.1% in 2011 alone. I view this as

management’s attempt to artificially prop up the stock price along with

maintaining ratios as results have plateaued and begin their inauspicious

descent. It also takes significant cash to maintain these repurchases again a

form of economic cannibalization..

Up to this point I seem to

be forecasting a disastrous spiral into irrelevance for Walmart, but let me be

clear that the firm is not going away any time soon. Walmart has about 4.8x the

annual revenue of Amazon and the firm’s accessibility around the world is

unmatched. Also of similar importance, Walmart is a good risk averse investment

for those who depend on large dividends from blue chip companies as annual

income. However it is my opinion that these very things that make Walmart a

risk averse asset in the short term could spell trouble further out; decreasing

cash flows, waning profitability, breached competitive advantage, a high

dividend payout to appease shareholders, and the continuous eating of shares to

prop up the stock price all portray Walmart’s imminent cash problem for the

future.

Conclusion

Overall, I think the better

buy is Amazon, but not for the reasons you might think. Personally, I do not

believe Amazon’s future lies with their online retail, but rather the firm’s

AWS (Amazon Web Services) subsidiary. With strong growth prospects for their

AWS segment, my DCF came to a price target of $924.34 per share for Amazon.

Amazon is an incredible growth story with endless potential in a world where

people demand to get products quickly without any real effort, but the firm’s

core online retail business has not made money.

The business idea is

terrific, but in order for Amazon to make money they need to raise the annual

“Amazon Prime” fee well above $99. The issue is that price increases will steer

customers away, so Amazon needs to make a choice. Should they continue their

low priced “Amazon Prime” to increase their customer base and revenues while

making no profit? Or should they increase prices, which will drive away some

customers but will result in profit generation?

The question is whether Bezos can slash costs, most notably shipping

costs, while maintaining a high quality and expedited shipping process.

As of now, that seems more

like a pipe dream than a reality.

However, this past week, Amazon entered into a partnership with Atlas

Air in order to add twenty Boeing airplanes to its operations, so it is not for

a lack of trying. Amazon’s core business reminds me of the tech bubble of

1999-2000. Amazon’s P/E of 295.93 is nothing short of crazy and already prices

in projected best case success for the firm. The reality is that Amazon has

been operating for 22 years and their core business still cannot generate a

profit. The core business’ inability to generate a profit will catch up with

the firm and its stock price unless they adapt. The laws of finance can be

bent, but they will not break. Fortunately for Amazon I believe the fundamental

growth prospects from high investment has and will continue to produce ground

breaking innovation resulting in realized growth.

If Amazon is going to

generate a substantial profit, it will be realized through their promising AWS

subsidiary. This may sound contradictory, as I said Amazon reminds me of the

tech bubble, but here I am championing their “tech” segment.

Source: Techcrunch

However, the situation is

quite different. Amazon’s AWS segment has posted increasing profits and is well

ahead of the competition in the cloud computing industry. From Amazon’s

website, “Amazon Web Services (AWS) is a secure cloud services platform,

offering compute power, database storage, content delivery and other

functionality to help businesses scale and grow”. The segment is posting a

bigger operating income than Amazon’s core business.

Source: Seekingalpha.com

AWS accounts for about 8%

of the firm’s revenue but over half of their profitability in the first quarter

of 2016. Businesses are buying into AWS faster than any other cloud-computing

firm in the industry. Netflix delivers its streaming capabilities through AWS;

Healthcare.gov runs partly through the service, and music giant Spotify is

built on the service as well, just to name a few. Amazon even engineered a

custom cloud for the CIA and other intelligence agencies in order to share

information. It is apparent that AWS has quietly become a vastly important

service.

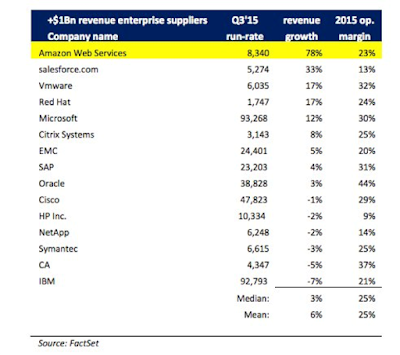

In this table we see that

Amazon’s AWS is witnessing the best of both worlds that it cannot quite find

within its core business, which is tremendous growth in revenues along with

profit generation. The operating margin is in line with the industry while

swiftly increasing market share at an unmatched pace. Overall, I believe AWS is

the future for Amazon. All businesses need cloud computing to operate in the

21st century. Businesses contemplating making the switch seem to flock to AWS

in droves. Deutsche Bank recently stated that if AWS were a standalone

business, it could easily be valued at around $160 billion.

Walmart had its success in

the past, but the decrease in revenues and overall financial performance in

2016 foreshadow what will be a slow descent from atop the retail pedestal. My

DCF resulted in a price target of $65.03 for Walmart. With tremendous growth

and profitability in AWS, Amazon essentially buys itself time to figure out how

to iron out their core online retail business to generate profitability. If

Amazon does continue its burst onto the retail scene and finally improve

margins, Walmart will have to adjust its strategies or cash flows will erode

while the firm continues to spend huge amounts of cash on dividends and share

buybacks, effectively leading the firm into self-cannibalism.

So if I had $700 sitting around, I would much rather have one share of Amazon than ten shares of Walmart!

So if I had $700 sitting around, I would much rather have one share of Amazon than ten shares of Walmart!